Rating factors that have little to do with an individual’s driving abilities appear to have considerable bearing on the price consumers pay for auto insurance, a report from Consumer Federation of America (CFA) asserts.

CFA also says the rating factors in question discriminate against low- and middle-income drivers.

The CFA released its third report this year examining the affordability of auto insurance and its impact on moderate income individuals’ mobility and access to better paying jobs.

In this latest report, the consumer-advocacy group examined how non-driving rating factors can affect the cost of auto insurance, increasing the price of coverage by as much as 50 percent or more depending upon location and insurer.

The report examined the price of minimum-liability insurance for a 30-year old woman working as a bank teller, with a clean driving record, high school education, and insurance coverage that lapsed 15 days ago. Quotes were sought from the websites of the five largest U.S. insurers in Baltimore, Miami, Louisville, Houston and Los Angeles. A quote was obtained for the individual under the standard information provided. Then new quotes were obtained adding five different rating factors:

• Married.

• Homeowner.

• Professional.

• No break in coverage.

• Higher-income zip code.

With each factor, the price of insurance declined, and when all five rating factors were added to the quote, the change in price was as high as 73 percent.

In Ontario, only marital status and some lapses in coverage are rating factors. As well, territorial rating is permissible but not at the postal code level.

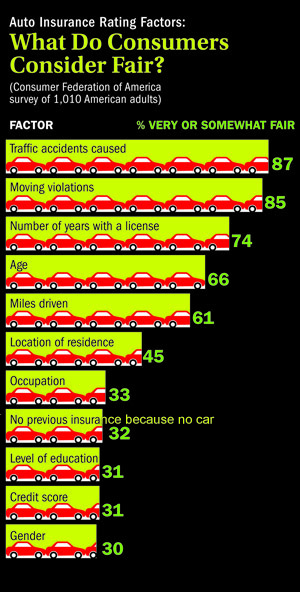

The report also includes a survey of 1010 adult Americans performed by CFA and ORC International asking what they thought about the use of specific factors to set auto insurance premiums (see chart below).

In response, Willem Rijksen, a spokesman for the American Insurance Association points out that the use of these factors, such as credit-based insurance scoring, location of the vehicle, driver experience, and traffic citations, helps insurers to more accurately price risk. Neil Aldridge, senior vice president for state and policy affair for the National Association of Mutual Insurance Companies commented that rating factors should not be “regulated by popularity,” adding, that “is not exactly a precise way to measure risk.”

read more here...CFA report is here...

You know those warning labels on things like hair dryers? The ones that tell you not to use the hair dryer while you are in the tub or shower?

You know those warning labels on things like hair dryers? The ones that tell you not to use the hair dryer while you are in the tub or shower?